February 10, 2026

February 10, 2026

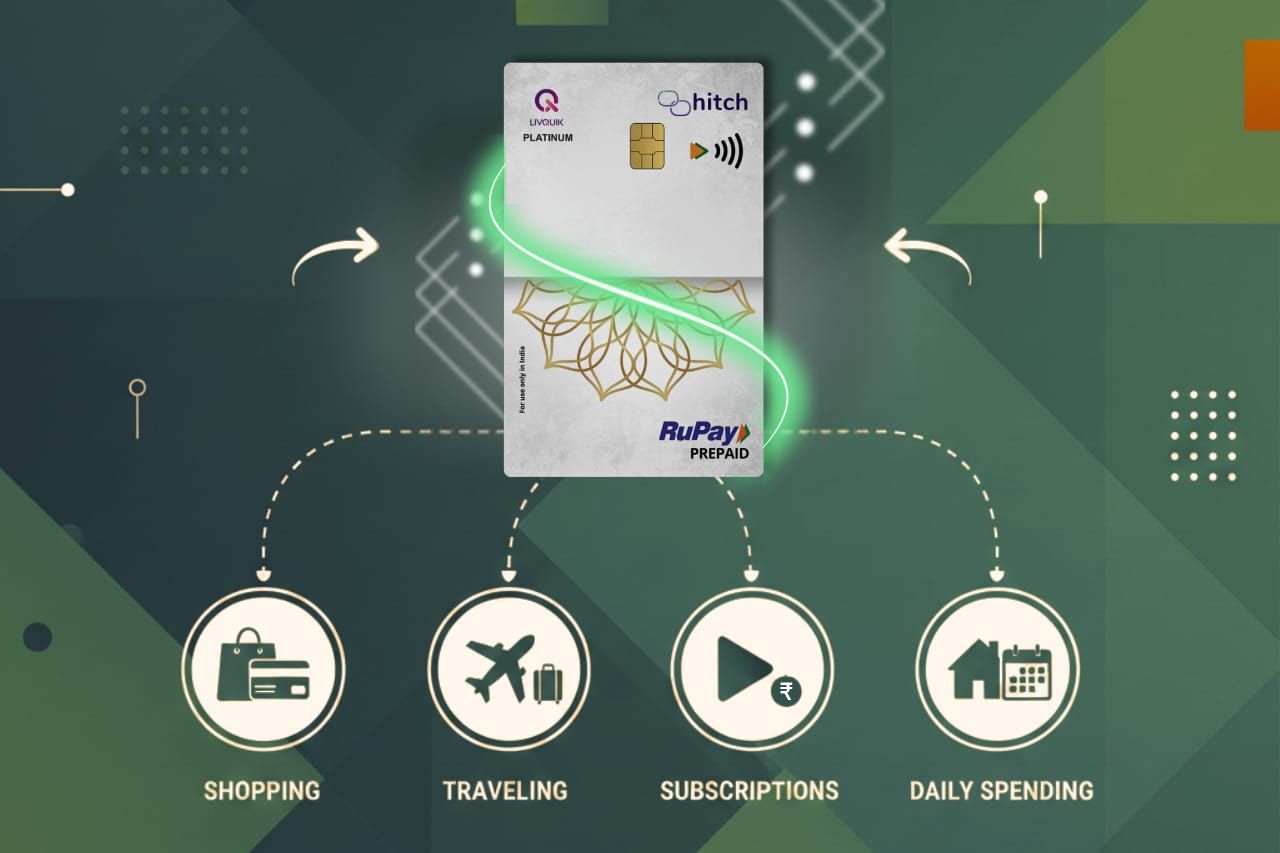

It is not easy to manage the day-to-day spending in a fast-paced cashless world. That is why it is easy to lose track of your money due to the abundance of payment options, subscriptions, impulse purchases, and hidden expenses. That is where prepaid cards can step in, as a smarter method of keeping your spending under control without the dangers involved with credit or debit cards.

1. Set Spending Limits and Stick to Them

Prepaid cards will only enable you to load what you want to spend. This is a mere gesture that establishes a psychological barrier. You could be planning to spend INR 5,000 on groceries or spending INR 2,000 on transportation, but either way, the card will only allow you to spend up to the limit of your wallet, which can help you spend less without necessarily having to resort to willpower to do so. It is like a spending envelope, but it is digital: when it is spent, it is spent. This structure is conducive to discipline, which is particularly helpful when one is new to managing their own finances or wants to come out of debt cycles.

2. Track Every Transaction Easily

Prepaid cards usually have an application or dashboard that tracks all transactions in real time. With this kind of transparency, it becomes simpler to see where your cash is going - whether it is spending money on small cafes or on utility bills. With prepaid cards, you have a digital record compared to money, where costs disappear. In the long run, such logs enable you to identify patterns in your spending and make decisions that are more financially sound.

3. Avoid the Risk of Overdrafts or Hidden Charges

The threat of overdraft charges or unforeseen withdrawals is one of the biggest problems with standard debit or credit cards. In the case of prepaid cards the maximum amount you will ever spend is the amount you loaded on it hence the zero chance of going into a negative balance.This is a safer option, particularly to those students, freelancers, or individuals with fixed budgets who would prefer not to pay late payments, overdrafts, or unwarranted penalties.

4. Control Category-Based Spending

Wish to spend special budgets on food, traveling, or entertainment? This is ideal with prepaid cards. Load cards individually or track amounts individually in various categories it is like using envelopes or jars but is smarter and digital. It is particularly useful for the family members, flatmates, or couples who would prefer to distribute common costs or provide assurance that there is no over-spending in a particular area on monthly limits.

5. Protect Your Bank Account

Online shopping or bill payments done with a prepaid card does not make your primary bank account information available. It only affects the amount you have already loaded in the event of security breach or malicious transaction - your savings remain intact.This level of security brings a sense of relief particularly in the current age whereby digital fraud is increasing.

Prepaid cards are simple and structured. Whether budgeting for personal expenses or household budgets, they are useful to relieve financial pressure, develop positive habits, and enhance money consciousness.

A prepaid card can be the smartest step you ever take if you are willing to take charge of your day-to-day spending without having the baggage of credit.