March 11, 2025

March 11, 2025

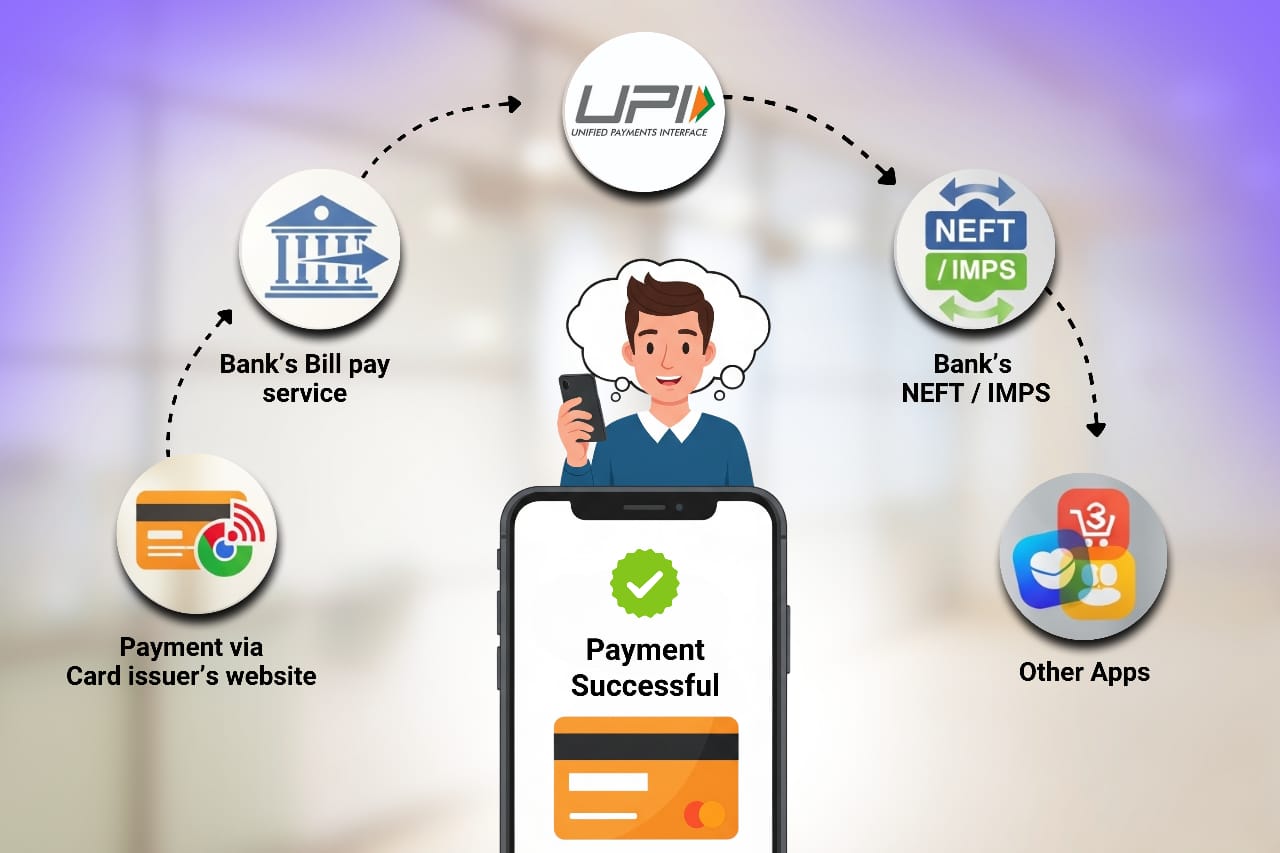

Managing credit card payments has become more seamless with digital banking. While both online and offline options exist, online methods such as net banking, IMPS, NEFT, and auto-debit offer speed, convenience, and reliability. Timely payments not only help avoid penalties but also support a healthy credit score.

Net Banking

Net banking remains one of the most straightforward ways to pay your credit card dues. If your savings account is with the same bank that issued your credit card, simply register the card within your net banking profile and initiate payment instantly. For accounts with other banks, you can still use internet banking by linking your credit card manually.

IMPS (Immediate Payment Service)

IMPS is a 24/7 real-time payment system that allows users to transfer funds, pay bills, and settle obligations quickly. Accessible via mobile apps, SMS, ATMs, and bank branches, IMPS ensures instant processing and confirmation.

NEFT (National Electronic Funds Transfer)

NEFT enables interbank transfers through online banking. To pay your credit card bill via NEFT, add your card as a beneficiary by entering details such as the card number, cardholder name, issuing bank, branch address, and IFSC code. Payments are processed in scheduled batches.

Auto-Debit Facility

For hassle-free payments, consider activating the auto-debit feature. You can request this service through your bank or set it up via net banking. On the due date, the bill amount is automatically deducted from your linked account, ensuring you never miss a payment.

Understanding and utilizing these online payment methods empowers credit card holders to stay financially disciplined. With timely payments, you safeguard your credit score and avoid unnecessary charges—making digital tools an essential part of modern financial management.