February 27, 2025

February 27, 2025

Credit Card Payments: Everything You Need to Know

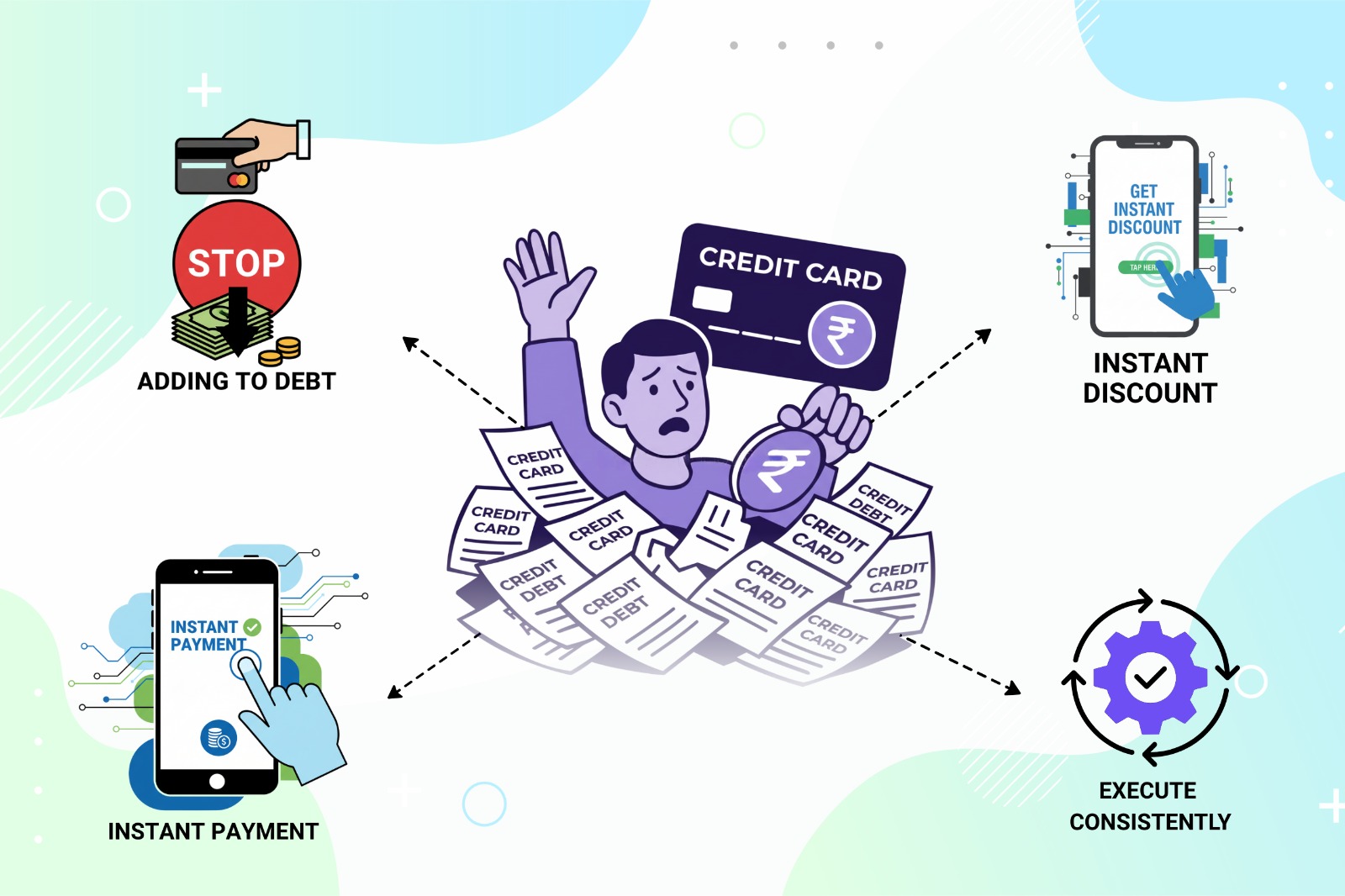

As credit usage becomes more common, understanding your credit card bill is essential. While some details are straightforward, others can feel like cryptic calculations. But once decoded, your bill reveals valuable insights into your spending habits and financial health.

What Your Credit Card Bill Includes

Your monthly statement outlines:

Outstanding Balances: This includes both current charges and any unpaid amounts from previous billing cycles.

Cash Advance Fees: If you’ve withdrawn money using your credit card, expect a separate charge—often with higher interest and no grace period. Use only in emergencies.

Balance Transfers: Moving debt from one card to another doesn’t erase it—it simply shifts it. Your bill will reflect transferred amounts and any associated interest.

Avoiding Interest Charges

To steer clear of accumulating fees, aim to pay your full balance before the due date. This helps prevent compounding interest and keeps your debt under control.

Why Understanding Your Bill Matters

In short, clarity leads to control—and control leads to financial confidence.