March 5, 2025

March 5, 2025

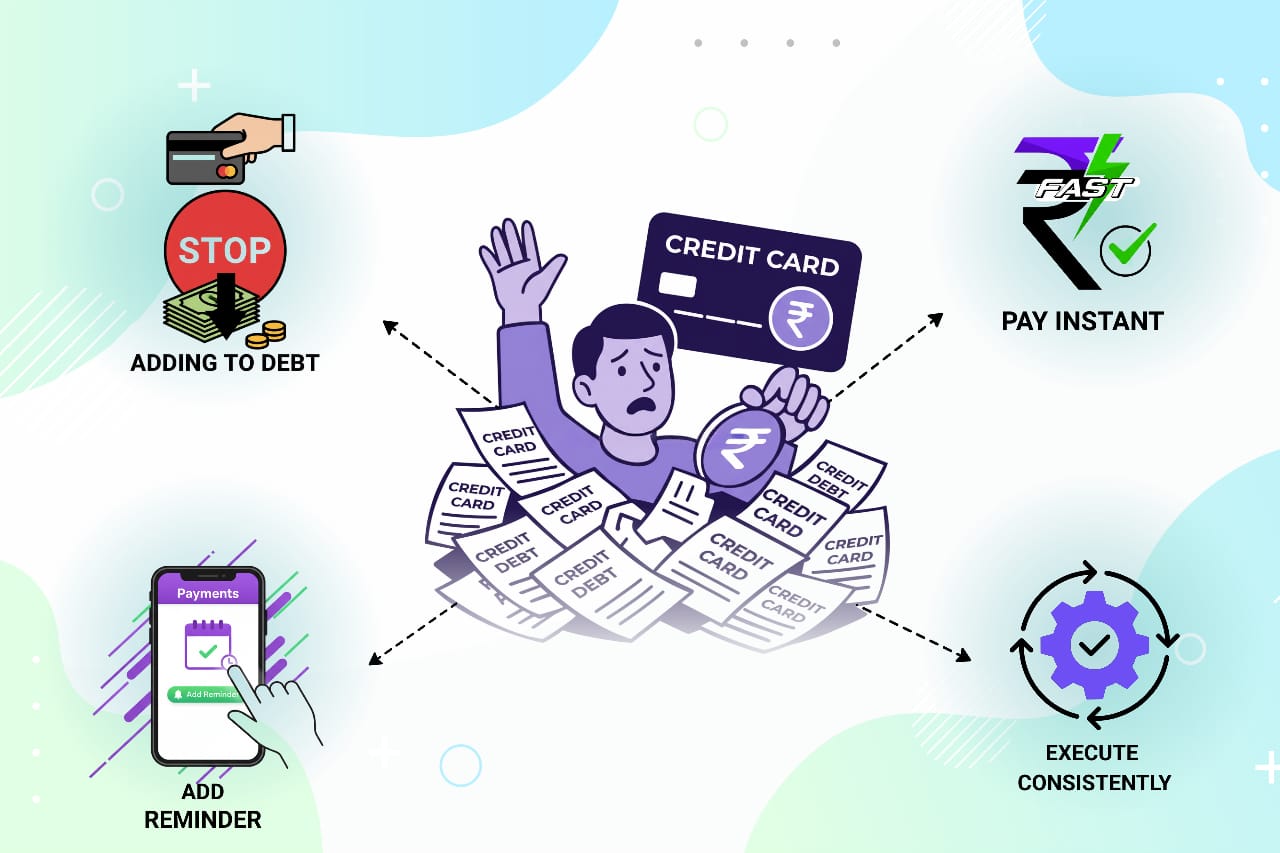

Credit cards offer unmatched convenience—from groceries to emergency expenses—but they can quickly become a financial burden if misused. The key isn’t just spending wisely, but also mastering the art of repayment.

Here’s how to tackle your credit card bills with speed and strategy:

Prioritize High-Interest Cards First

Don’t just chase the biggest balance—target the card with the highest interest rate. This minimizes future interest charges and saves you money in the long run.

Break Down the Bill

Instead of viewing your total debt as one overwhelming figure, divide it into smaller, manageable portions. This helps you stay focused and reduces mental stress.

Avoid Minimum Payments

Paying only the minimum might seem like a relief, but it prolongs debt and damages your credit score. Aim to pay more than the minimum whenever possible.

Track Spending & Stay Disciplined

Banks monitor your usage. Excessive or erratic spending can lead to credit limits being slashed or cards being suspended. Keep your expenses in check.

Use the Snowball Effect

Once the high-interest card is paid off, move to the card with the lowest balance. Clearing smaller debts gives you a psychological boost and builds momentum.

Speedy repayment isn’t just about money—it’s about peace of mind. By following these smart strategies, you’ll not only reduce your debt faster but also strengthen your financial reputation.