January 10, 2025

January 10, 2025

Navigating FASTag Fees Without Confusion

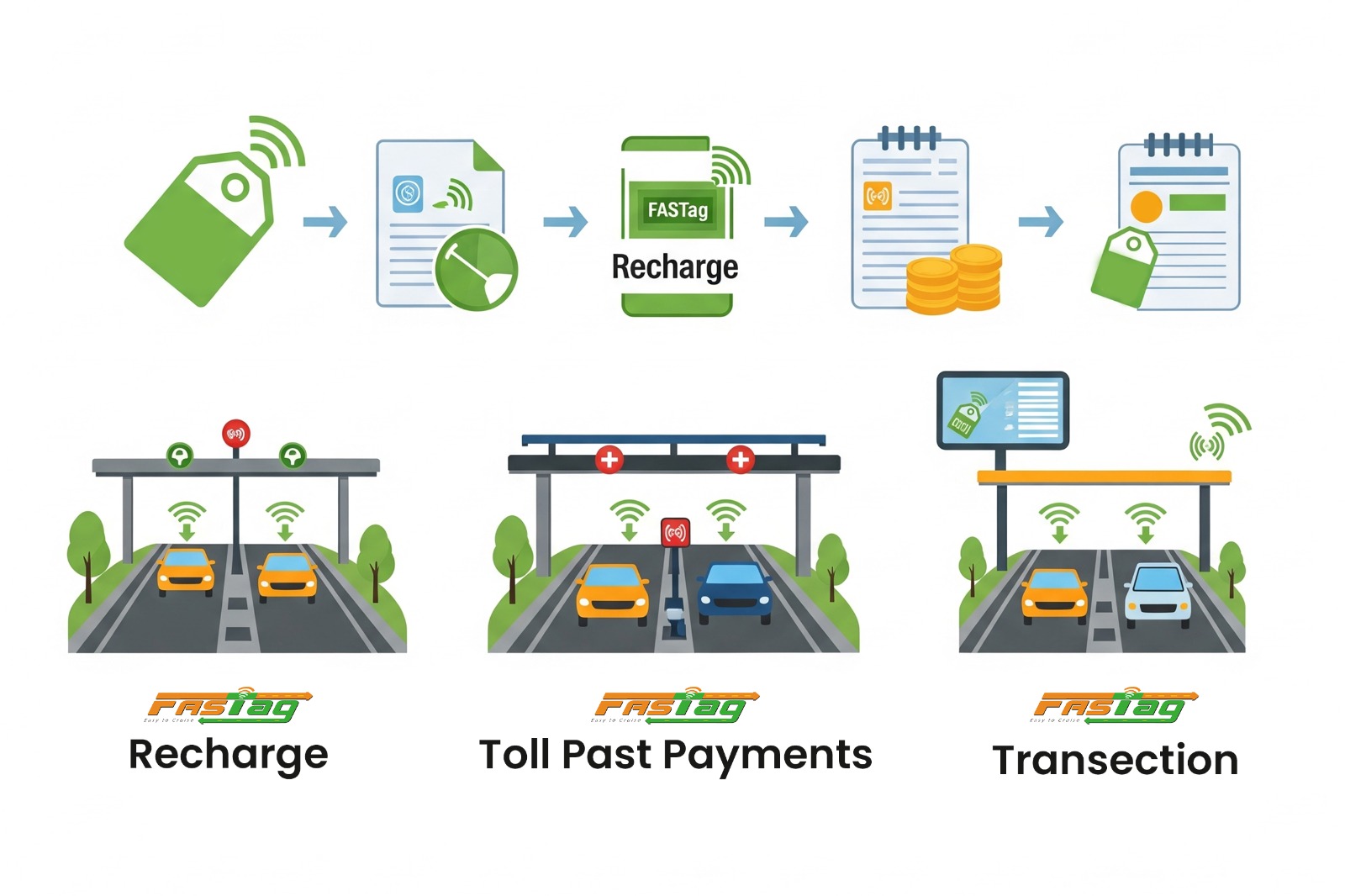

FASTag has revolutionized toll payments in India, offering seamless transactions and reducing wait times at toll plazas. But, understanding its associated fees is crucial to avoid any surprises. Let’s dive into the various charges, so you know what to expect!

Breaking Down FASTag Charges

Tag Joining Fee

Your first step into the FASTag club comes with a one-time fee of Rs. 100 (including taxes).

Security Deposit

Think of this as your FASTag’s safety net. It’s refundable upon account closure, provided there are no outstanding charges. Deposits vary based on vehicle type—Rs. 200 for cars and Rs. 400 for trucks.

Threshold Amount

To keep your FASTag running smoothly, a minimum balance is required, which depends on your vehicle class.

Reloading Charges

While topping up your FASTag wallet, some banks charge minimal convenience fees. For example, HDFC Bank applies a 1.10% fee on credit card recharges and 1% on debit card recharges.

Re-Issuance Charges

Lost or damaged your FASTag? A replacement fee of Rs. 100-150 ensures you get a new one hassle-free.

FASTag Becoming More Wallet-Friendly

Recent changes by the National Highways Authority of India (NHAI) have lowered security deposits for commercial vehicles to Rs. 150, making it more affordable than the previous Rs. 400-500 range. Additionally, the government has mandated free issuance of FASTags through selected banks, enhancing accessibility.

The Convenience That FASTag Offers

FASTag isn’t just about toll payments—it’s about saving fuel, time, and reducing congestion. To keep your experience smooth:

1. Maintain the Minimum Balance for Uninterrupted Transactions

FASTag operates on a prepaid system, meaning that your account must always have a minimum balance to ensure smooth toll payments. If your balance drops below the required threshold, your FASTag may become inactive, leading to delays at toll plazas and possible penalties. Regularly monitoring your balance and setting up auto-recharge options through your bank or payment apps can help avoid disruptions. This proactive approach guarantees seamless travel and prevents last-minute inconveniences.

2. Check for Bank-Specific Fees Before Recharging

Different banks and service providers may impose convenience fees on FASTag recharges, which can vary based on the payment method used. For instance, credit card recharges may incur a slightly higher fee compared to UPI or net banking transactions. Before adding funds, it’s advisable to check your bank's latest fee structure to avoid unexpected deductions. Some banks even offer zero-fee recharge options during promotional periods, so staying informed about these offers can help save money in the long run.

3. Ensure Your FASTag is Properly Affixed to Avoid Damage

A FASTag sticker should be securely placed on the windshield of your vehicle to allow toll scanners to read it effectively. Improper placement or damage to the tag can result in transaction failures, forcing you to pay toll charges in cash. Additionally, prolonged exposure to extreme heat, moisture, or physical handling may weaken the adhesive or damage the RFID chip inside the tag. To avoid such issues, ensure that the FASTag is firmly affixed in the recommended position, away from direct sunlight and protected from potential wear and tear. If damaged, immediately request a replacement from your provider to continue enjoying hassle-free toll payments.

By following these steps, you can ensure uninterrupted toll transactions, avoid extra fees, and maintain the longevity of your FASTag, making your journeys smooth and stress-free. Let me know if you need any refinements!

Drive Hassle-Free with hitch – Download Our App Today!

Make seamless payments with hitch and stay stress-free on the road.